See Our Latest Blogs

Stay up to Date on the Latest News In The World of startups!

Business Credit and Personal Credit?

What is personal credit?

Personal credit refers to the credit score and credit history of an individual. It is based on things like payment history, outstanding debt, and length of credit history. This is the credit score that many people are familiar with, and it is what is commonly used by lenders when evaluating an individual's creditworthiness.

2. What is business credit?

Business credit, on the other hand, is based on the creditworthiness of a business rather than an individual. It takes into account things like the business's payment history, outstanding debts, and how much credit the business has available. Business credit scores are used by lenders when evaluating a business's ability to repay loans and other financial obligations.

3. Why is it important to separate personal and business credit?

There are a few reasons why it is important to separate personal and business credit. First, having a separate business credit score can help protect your personal credit score. If you use your personal credit to finance your business, missed or late payments can negatively impact your personal credit score. Additionally, if your business runs into financial trouble, it can be easier to restructure and manage the debt if it is separate from your personal finances.

4. How can you establish business credit?

To establish business credit, you need to start by incorporating your business and getting a separate tax ID number (EIN) from the IRS. After that, you can open a business bank account and start applying for credit in your business's name. It can take some time to establish business credit, but it is an important step for any business owner.

5. How can you maintain good business credit?

Maintaining good business credit is similar to maintaining personal credit. You need to pay bills on time, keep your debt-to-credit ratio in check, and avoid applying for too much credit at once. It can also be helpful to monitor your business credit score regularly to catch any errors or fraudulent activity.

Conclusion:

In summary, understanding the difference between personal credit and business credit is crucial for any prospective business owner. By separating the two, you can protect your personal credit score and give your business a solid financial foundation. Establishing and maintaining good business credit takes time and effort, but it is an important step towards financial stability and success.

Book Your FREE Coaching Call

Driving Growth, Amplifying Impact

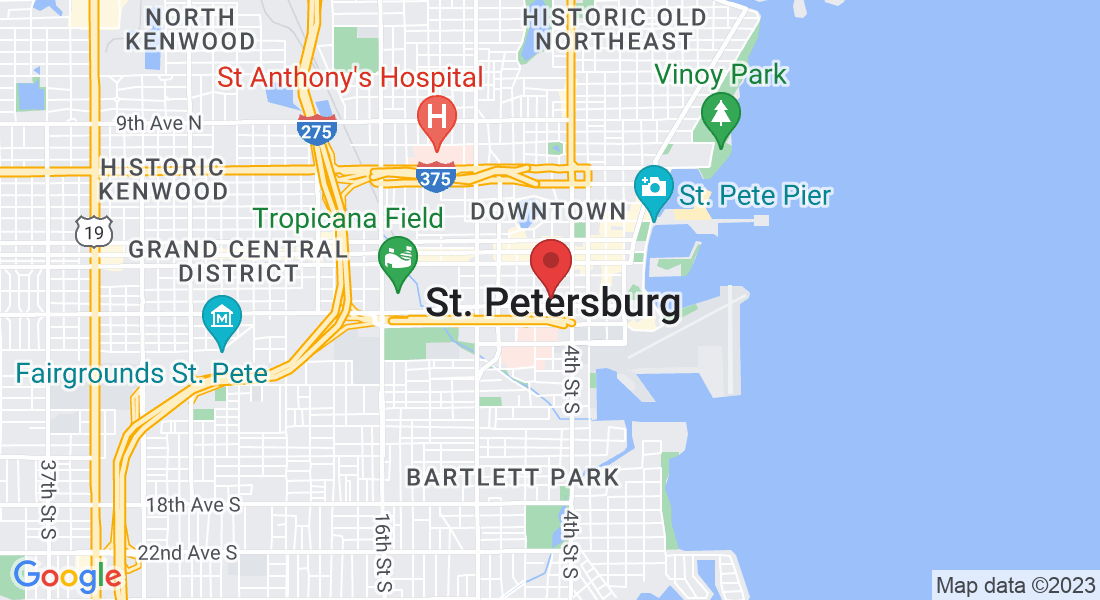

Anthony Williams

Anthony is a fixture in his community from coaching High School football to Volunteering in local Politics. Running multiple businesses in the real-estate, Tax preparation and Retail industries Anthony's experience will help new startups meet their goals.

Tim Casiglia

With business startup experience in the Service, Logistics and Information Technology industries Tim has wide ranging experience that translates to problem solving skills needed for new business ventures.

Our Team

Years of experience.

Varying fields of expertise.

Our staff has the knowledge.

Our Team has the resources.

Guiding new start ups to success every time.

Unleash Your Business Dreams.

Guidance. Support. Success.

© 2026 Inc2Biz - All Rights Reserved,